BUILDING STRENGTH,

STABILITY, & SELF-RELIANCE

THROUGH SHELTER

We strive for a better world where everyone has a decent place to live.

We all have the potential to stand on our own.

We are Thankful for Our Partners who Help us Grow!

Click below to see the amazing companies and organizations working with us.

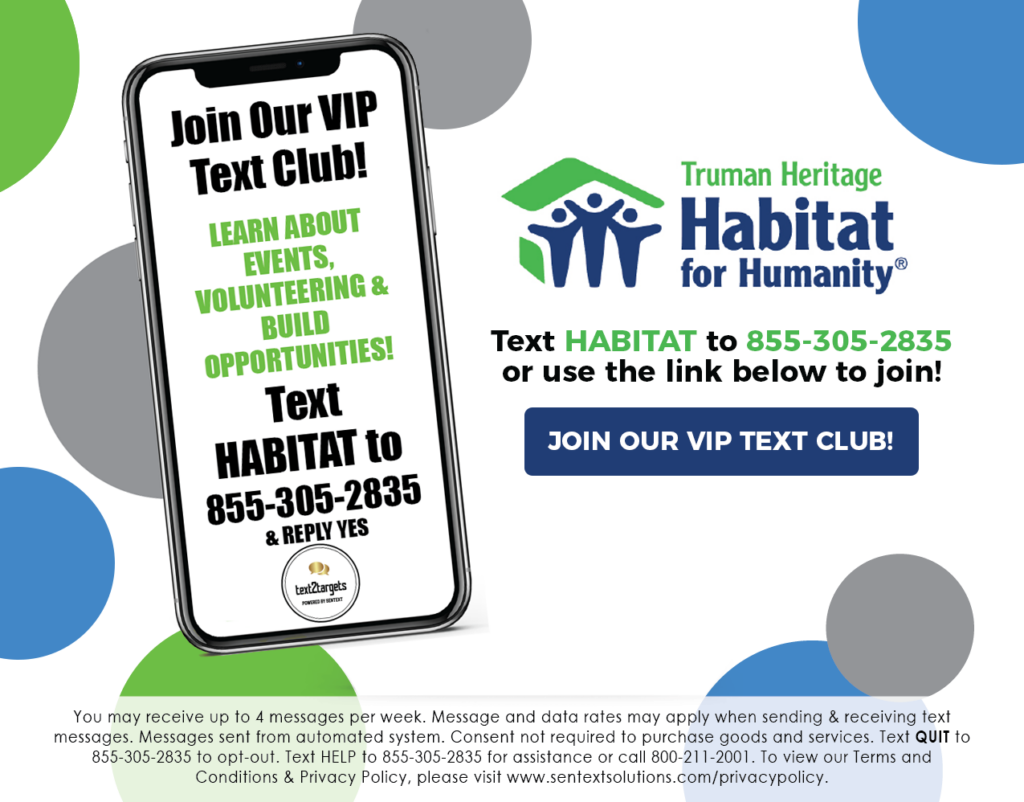

Stay up-to-date with all our exciting events and news!

Get in Touch. Get Involved.

Join our movement and help give families a hand up.

505 North Dodgion Avenue

Independence, Missouri 64050

Call Us: 816-886-7374

Call ReStore: 816-886-7374

Follow Truman Habitat for Humanity

Blue Springs ReStore

816-886-7374

Independence ReStore

816-886-7374

Lee's Summit ReStore

816-875-6556

Truman Heritage Habitat for Humanity of Eastern Jackson County, Missouri complies with the U.S. policy for the achievement of equal housing opportunity throughout the nation. We support an affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, national origin, age, marital status, sexual orientation, or sources of income.

Privacy Policy | © Copyright 2022

Truman Heritage Habitat for Humanity

505 North Dodgion, Independence, MO 64050 - 816-886-7374

NON-PROSELYTIZING POLICY

Truman Heritage Habitat for Humanity of Eastern Jackson County, Missouri is a Christian, faith-based non-profit. However, we will not offer assistance on the expressed or implied condition that people must adhere to or convert to a particular faith. Questions? Click here to send us a message.